How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

12 min read

![]() Masterplans Staff

Jan 3, 2023 2:34:40 PM

Masterplans Staff

Jan 3, 2023 2:34:40 PM

Over the past 20 years that Masterplans has been in operation, we've witnessed a significant evolution in market research methodologies. In the dynamic business landscape of 2023, market research remains a cornerstone of successful business planning.

As information has become more widely available, lenders and investors are seeking more of it than ever before. Every good business — and business plan — is supported by extensive market research. The advent of new tools and technologies has made obtaining valuable data for business decisions more accessible and efficient than ever before. In this article, we delve into the importance of market research, explore the different types of research, and highlight the cutting-edge tools available to conduct it effectively.

Market research, as defined by the Small Business Administration (SBA), "blends consumer behavior and economic trends to confirm and improve your business idea.” It's a vital process for business owners, providing valuable insight into market trends, potential customers, and competitor analysis.

Market research is a critical component of a business plan. It helps businesses understand their target market, identify potential customers, and analyze the competitive landscape. It also provides valuable insight into industry trends, helping businesses make informed decisions about their marketing strategy and financial plan.

Market research is divided into primary and secondary research. Primary research involves data collection directly from the target market through methods like surveys and interviews. This type of research provides direct feedback from potential customers, making it a valuable tool for understanding customer needs and preferences.

For example, a business owner planning to open a new restaurant might conduct primary research by surveying potential customers in the area to understand their dining preferences and willingness to try a new restaurant. They might ask questions about preferred cuisine types, price points, and dining frequency to gather data that can inform their business plan.

Secondary research, on the other hand, involves gathering and synthesizing data published by others. This type of research is often referred to as secondary market research. It can provide valuable insight into industry trends, market size, and competitive landscape, making it a useful tool for business planning.

For instance, the same restaurant owner might use secondary research to study industry reports on dining trends, review census data on demographics in the area, and analyze competitor menus and pricing. This information can help the owner understand the market and competition, and make informed decisions about their restaurant concept, menu, and pricing.

Market research plays a crucial role in business planning. It helps businesses understand their target market, identify potential customers, and analyze the competitive landscape. It also provides valuable insight into industry trends, helping businesses make informed decisions about their marketing strategy and financial plan.

A well-conducted market research can serve as the GPS for your company’s growth journey. It not only helps in determining product-market fit but also validates the assumptions underlying the financial forecast. For instance, if your market research tools indicate that companies in your industry spend 50% of their revenue on direct costs, your business plan must explain why if you deviate significantly from industry standards.

Good market research is never based on a hunch. It should be backed by cited, current, and reputable sources. This ensures the credibility of your business plan and the effectiveness of your marketing strategy. In other sections of the business plan, such as your marketing plan or your company description, there is room for you to be subjective. But market research is different, and must be backed by cited, current, and reputable sources.

There are numerous tools available for conducting market research, each with its own benefits and drawbacks. To help you understand the pros and cons quickly of the various options, we developed a scoring system to evaluate them. Our rankings are based on a score of 1-10 on these seven categories:

The rankings of these tools are subjective and should be used for information. We definitely recommend trying them for yourself and coming up with your own opinions.

For established businesses, the first point of reference is often their own customer data and interactions. However, startups typically don't have this data to draw on. Therefore, they need to rely more heavily on market research tools to gather the necessary data. By evaluating these tools based on the seven factors above, we aim to help startups choose the tools that will best meet their needs and contribute to their success.

The internet provides access to a wealth of information, from industry trends and market size to customer behavior and competitive analysis. However, it's important to assess the credibility of the sources and the timeliness of the data. Websites like Google Trends, Social Mention, and Google Keyword Planner can provide valuable insights into consumer behavior and market trends.

One of the most effective ways to use the internet for market research is by leveraging the power of search engines. Get really specific and you'll get better results (here are some tips and tricks for internet searches). Search engines allow you to filter results by date, ensuring you're accessing the most recent and relevant information. This is particularly useful when researching market trends, as it allows you to stay up-to-date with the latest developments in your industry.

To filter results by date on Google, simply conduct a search, then click on "Tools" under the search bar. A new menu will appear below, where you can select the desired time range. This can be as specific as the past hour, or as broad as the past year or any custom range.

In addition to general search results, news articles can be a valuable source of information for market research. News outlets often report on industry trends, providing timely and relevant information for your research.

To find news articles, you can use the "News" tab on Google search, or visit news aggregation sites like Google News or Bing News. These platforms gather news from various sources, allowing you to access a wide range of information in one place. Remember to consider the reputation of the news source when evaluating the information.

Your local library can be a great resource for market research. They house not only a variety of general and industry-specific books but also provide access to valuable digital resources. Librarians, skilled in information science, can guide you in navigating these resources.

Libraries often subscribe to databases like Data Axle Solutions, which a particularly useful tool for businesses. It provides access to detailed information on more than 20 million active U.S. businesses. This can be incredibly useful for understanding your competition, identifying potential customers, or even finding suppliers.

In addition to databases, libraries may have access to directories and encyclopedias that offer valuable information about specific industries and markets. Libraries also often have business centers or sections dedicated to business and industry resources, which can be useful for understanding your local market.

Many industries have trade associations that collect and publish valuable business data. These organizations often serve as the pulse of their respective industries, conducting regular surveys and publishing reports on the latest trends, challenges, and opportunities in their specific fields.

For example, the National Restaurant Association, a trade group for the restaurant industry, publishes an annual report on restaurant industry trends. This report includes data on sales, workforce, consumer preferences, and more. For a restaurant owner, this report can provide invaluable insights into the current state of the restaurant industry, emerging trends, and future predictions.

In addition to national associations, there are often regional or local trade associations that provide data specific to a certain area. This can be particularly useful for businesses operating in a specific region or state.

It's also worth noting that many trade associations host events, such as conferences and webinars, that can provide additional opportunities for learning and networking. Marketing Mentor has curated a categorized list of industry associations.

Government agencies like the Bureau of Labor Statistics (BLS) and the US Census Bureau regularly publish reports and statistics on a wide range of topics, providing valuable information for your business plan.

The Bureau of Labor Statistics, for instance, publishes data on employment and wage trends by occupation and industry. This can be particularly useful for understanding labor costs in your industry, which is a key factor in your business's financial plan.

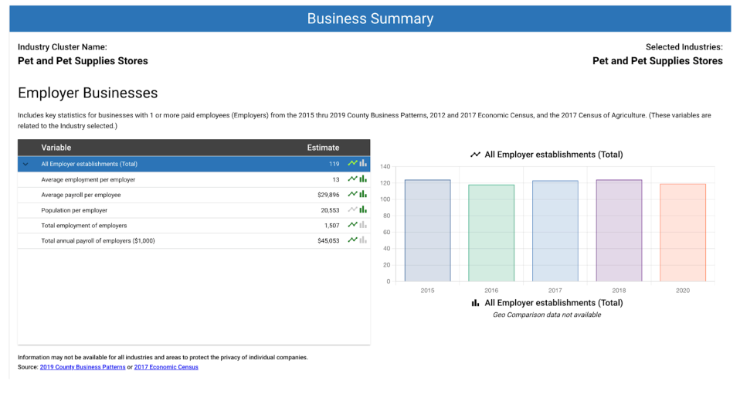

The US Census Bureau, specifically the Census Business Builder (CBB), provides data on population size, age distribution, income levels, and more. This information can be invaluable for understanding your target market and identifying potential customers. Here's a screenshot of a report on the pet store industry in Portland, Oregon:

Podcasts can be a valuable source of industry-specific information. They often feature interviews with industry leaders, discussions on current trends, and deep dives into various topics, providing valuable insights and advice. By listening to these podcasts, you can gain a deeper understanding of the industry trends, challenges, and opportunities.

For example, "Retail Gets Real" is a podcast by the National Retail Federation that offers insights into retail trends and the future of the industry. "The Beauty Brains" is a podcast by cosmetic scientists who answer questions about cosmetic products, providing valuable insights for anyone in the beauty industry.

Vendors and suppliers are often deeply embedded in the industry and have a vested interest in understanding the market dynamics. As such, they can provide valuable insights into industry benchmarks, trends, and the competitive landscape.

Vendors and suppliers interact with a wide range of businesses within the industry, giving them a broad perspective on what's happening in the market. They can provide insights into which products are popular, what strategies are effective, and how the industry is evolving. For example, a supplier for a coffee shop might have information on the most popular types of coffee beans or the latest trends in coffee flavors.

In addition to providing insights into market trends, vendors and suppliers can also provide information about the competitive landscape. They can help you identify your competitors, understand their strategies, and find ways to differentiate your business. For instance, a vendor might provide information about the pricing strategies of your competitors, or they might share feedback they've heard from other customers about what's working and what's not.

Furthermore, vendors and suppliers can often provide technical expertise and advice that can help you improve your products or services. For example, a software vendor could provide advice on how to use their products more effectively, or a food supplier could provide tips on how to store and prepare their products to ensure the best quality.

Statista aggregates data from a wide range of sources, including market research reports, trade publications, scientific journals, and government databases. This means that instead of having to search multiple sources for information, you can find everything you need in one place. The data is presented in easy-to-understand charts and graphs, providing insights into market trends, consumer behavior, and the competitive landscape.

With Statista, you can access data on market size, market share, industry growth rates, and more. This can help you understand the current state of your industry, identify growth opportunities, and make informed business decisions. For example, if you're launching a new product, you can use Statista to find data on the size of your potential market and the growth rate of that market.

In addition to industry data, Statista also provides consumer data. This includes data on consumer demographics, behavior, and preferences. This can be particularly useful for understanding your target audience and tailoring your products, services, and marketing efforts to meet their needs.

Statista also provides data on the competitive landscape in various industries. This includes data on market share, company revenues, and more. This can help you understand who your competitors are, what strategies they're using, and how you can differentiate your business.

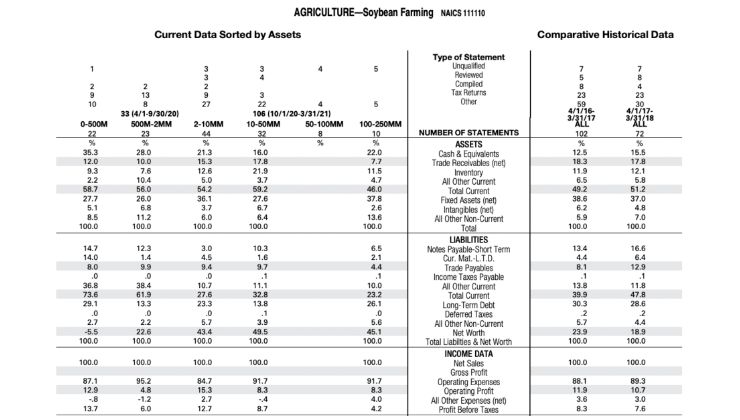

Risk Management Association (RMA) Data is a valuable tool that provides financial benchmark data for various industries. This data can be used to compare your business's financial performance with industry standards, helping you to identify areas for improvement and align your business with industry norms.

RMA Data is derived from financial statements of thousands of businesses and provides a wealth of information on industry averages for income and balance sheet items. This includes data on profitability ratios, leverage ratios, and liquidity ratios, among others. By comparing your business's financial performance to these industry benchmarks, you can identify areas where your business is underperforming and develop strategies to improve.

RMA Data can also be useful when preparing a business plan or pitch for potential investors. By showing that your financial projections are in line with industry norms, you can help to build credibility and reassure investors that your business plan is realistic and achievable.

There are reports for over 580 different industries (categorized by NAICS code), which contain five years of historical data, including financial ratios, sales, and asset sizes. Individual industry reports are $185, or you can get a one-year membership for all industries for $720.

As you can see from the above screen shot, these reports are dense and difficult to parse. The key pieces of information to measure your financial performance are located under “income data.”

IBISWorld is a leading provider of in-depth industry reports covering over 700 industries. These reports provide detailed information on industry trends, market size, competitive landscape, and key success factors, making it a valuable tool for market research.

Each IBISWorld report provides a comprehensive overview of a specific industry (download a free sample IBISWorld industry report). This includes an industry definition and supply chain analysis, which can help you understand how your business fits into the broader industry context. The reports also provide data on market size, which can help you understand the potential demand for your products or services.

One of the key features of IBISWorld reports is their analysis of industry trends. This includes data on historical trends, current performance, and future outlook. This can help you understand where the industry is headed and identify potential opportunities and threats. For example, if the report shows that an industry is expected to grow rapidly in the coming years, this could indicate a potential opportunity for your business.

IBISWorld reports also provide detailed information on the competitive landscape in an industry. This includes data on market share concentration, key success factors, and the major players in the industry. This can help you understand who your competitors are, what strategies they're using, and how you can differentiate your business.

In addition to industry reports, IBISWorld also provides reports on specific markets, demographic trends, and consumer behavior. This can provide additional insights that can help you understand your target market and develop effective marketing strategies.

ArcGIS Business Analyst Online is a geographic information system (GIS) tool that provides localized data, making it a valuable resource for market research. This tool can help businesses understand the geographic distribution of their target market, enabling them to develop more effective marketing strategies.

ArcGIS Business Analyst Online provides demographic, lifestyle, and spending data for specific geographic areas. This can include data on population size, age distribution, income levels, and more. By understanding the characteristics of the population in different areas, businesses can tailor their products, services, and marketing strategies to meet the needs of their target market.

For example, if a business is planning to open a new store, they can use ArcGIS Business Analyst Online to analyze the demographic characteristics of the population in different potential locations. This can help them choose a location where their target market is most concentrated.

In addition to demographic data, ArcGIS Business Analyst Online also provides data on consumer behavior and spending patterns. This can help businesses understand what products and services are popular in different areas, and how much consumers are willing to spend on these products and services.

ArcGIS Business Analyst Online also provides tools for visualizing data on a map. This can help businesses understand geographic trends and patterns, and make more informed decisions about where to target their marketing efforts.

In addition to the free industry reports discussed earlier in this post, some industries have more extensive paid industry reports. One example we use is STR hotel industry reports that tell us the permanence of hotels within a specific geographic area. Another report we buy every year is Marijuana Business Daily’s Factbook, which provides segmented data, state-specific policy information, and overall industry trends in the legal cannabis marketplace. Pricing for reports like these varies (for example, the MJBiz Factbook is $300, while the STR reports are $600 each). Others can be quite costly. The Beverage Information Group’s Liquor Handbook costs $3,200, but if you’re starting a liquor company, it’s probably a resource you’ll want to have on hand.

Artificial Intelligence (AI) is revolutionizing many fields, and market research is no exception. AI tools are becoming increasingly popular in market research due to their ability to process vast amounts of data quickly and accurately, uncovering insights that would be difficult, if not impossible, for humans to find manually.

Generative AI tools like ChatGPT-4, developed by OpenAI, can analyze text from various sources to identify trends, patterns, and insights that may not be immediately apparent. This can be particularly useful for analyzing competitors' websites to extract information such as pricing, key messages, product descriptions, and customer reviews. By processing this information, ChatGPT-4 can help identify market trends, competitive strategies, and potential opportunities for differentiation.

In addition to ChatGPT-4, there are several other AI tools emerging that are designed to assist with market research. For example, tools like Crayon and Kompyte use AI to track competitors' digital footprints, providing real-time updates on changes to pricing, product offerings, and marketing strategies.

AI-powered social listening tools like Brandwatch and Sprout Social can analyze social media posts and online conversations to provide insights into consumer sentiment and trending topics. These tools can help businesses understand how their brand is perceived, identify potential crises before they escalate, and discover trending topics that they can leverage in their marketing strategies.

The global generative AI market is expected to reach $42.6 billion in 2023. Furthermore, chatbots, virtual assistants, and voicebots captured 57.8% of VC investments in natural language interfaces in 2022. This suggests that we can expect to see an increasing number of AI tools emerging in the market research field in the near future.

While AI tools like ChatGPT-4 can provide valuable insights, it's important to remember that they are not infallible. AI tools often miss nuances or context that a human researcher would catch. Therefore, it's crucial to use AI tools as part of a broader market research strategy, and to always verify the insights they provide with other sources.

Furthermore, AI tools can sometimes generate misleading or inaccurate results if they are used incorrectly or if the data they are analyzing is biased or incomplete. Therefore, it's important to have a solid understanding of how these tools work and to use them responsibly.

At Masterplans, we rely on a combination of robust tools and strategies to conduct effective market research. At the heart of our toolkit are ArcGIS Business Analyst Online, Statista, and IBISWorld. These premium tools are just the starting point. We augment their insights with robust internet sleuthing, using AI tools and manual research to gather additional data and context.

The key to professional market research is weaving together multiple data points from different credible sources to create a narrative case for the startup's potential. A good business plan doesn't just have a list of stats — it's about informing stats with context and showing where the startup fits into the market landscape.

Whether you're launching a new product, entering a new market, or refining your marketing strategy, market research can provide the data you need to make informed decisions. By understanding your target customer, analyzing your competitors, and keeping up with industry trends, you can create a business plan that's grounded in reality and designed for success.

But remember, market research isn't a one-time activity. As your business grows and the market evolves, your understanding of your target market, competitors, and industry trends should evolve as well. Regular market research can help you stay ahead of the curve and adapt your business plan as needed.

In the end, the goal of market research is to help you make informed decisions that drive business growth. By understanding your market, you can create a business plan that resonates with your target audience, stands out from the competition, and positions your business for success.

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...