How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

5 min read

![]() Ben Worsley

Mar 30, 2023 2:00:49 PM

Ben Worsley

Mar 30, 2023 2:00:49 PM

In recent months, the headlines have been dominated by concerning economic developments.

Inflation, though gradually easing, remains elevated at 6% year over year in February. We continue to witness major tech and media conglomerates announcing massive layoffs, with Disney being the latest example. Just a few weeks ago, Silicon Valley Bank (SVB) experienced a crippling run on deposits, ultimately leading to its collapse. Furthermore, the Federal Reserve recently increased interest rates by an additional 25 basis points.

Collectively, these factors point towards the onset — or possibly even the presence — of a recession. Naturally, entrepreneurs may feel alarmed by this possibility, as evidenced by the increased number of internet searches for “recession-proof business ideas.” While I appreciate the intent behind such searches, I believe they may be asking the wrong question. Rather than fear a recession, entrepreneurs instead ask themselves how a business idea can adapt to market swings.

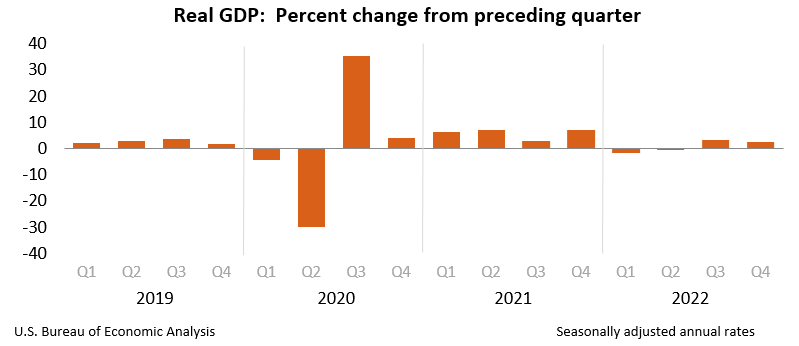

A recession occurs when the economy experiences a prolonged downturn, and a common way to identify it is by observing two consecutive quarters of negative GDP growth. While some economists may argue that this definition is too simplistic and that additional factors should be considered, this basic guideline provides a useful starting point for understanding the state of the economy.

Taking a closer look at the GDP data for the past few quarters, the GDP has exhibited growth during the last two quarters, with an increase of 2.7% in the third quarter of 2022.

You might wonder (because I had the same question) how inflation factors into the analysis. To address this concern, economists rely on “Real GDP” rather than nominal GDP, as it is specifically adjusted to account for the impact of inflation.

So as you can see, we’re not experiencing a recession at the moment, and according to the rule of two consecutive quarters of GDP decline, the earliest a recession could begin would be July.

Although we aren’t currently experiencing an official recession, it’s worthwhile to explore why politicians and leaders might be hesitant to categorize economic downturns as such. Understandably, no political figure would want to face re-election while bearing the burden of being associated with a recession’s emergence.

In my view, another significant factor is that labeling economic downturns can exacerbate the situation. This can be attributed to the psychological phenomenon of groupthink, where individuals prioritize conformity over critical thinking and evaluation, often leading to poor decision-making.

A recent example of groupthink and its effect on the economy is the bank run at Silicon Valley Bank. While I’m not a banker or an economist, it’s important to know the basics of how banks work to see how groupthink made this situation worse.

At their core, banks are businesses that safeguard the money of their customers, both individuals and businesses. They generate revenue by investing this money in various ways, such as loans and securities. It’s important to note that although your bank account may display a certain balance, the bank doesn’t hold all of that money in liquid form. This is why our deposits are insured by the FDIC. In essence, if all customers were to withdraw their money simultaneously, the bank would not have sufficient cash on hand to fulfill those requests.

Here’s a simplified breakdown of the events that unfolded at SVB:

At the time, SVB had around $172 billion in deposits, and an astounding 83% of those funds were being withdrawn in just two days. No bank could withstand such a massive outflow of funds.

There are two key takeaways from the SVB example. First, it demonstrates how quickly perception becomes reality. The mere indication that SVB was on unstable footing led to a panic that revealed its actual vulnerability.

More importantly, it’s essential to recognize that the problem with SVB was a unique case of a bank that was over-exposed to one industry and and didn't manage its interest rate risk well.

Let’s think about the huge layoffs in the tech and media industries. While these layoffs are definitely worrying and affect a lot of people and their families, it’s important to remember that these companies expanded their workforces quickly during the pandemic.

Prior to the pandemic, Amazon employed 800,000 individuals. As people became heavily reliant on Amazon during the pandemic due to the closure of retail stores, the company’s revenue surged. In response to the growing demand, Amazon went on a hiring spree, reaching 1.6 million employees by the end of 2021. As the pandemic subsided and reliance on Amazon decreased, layoffs ensued.

According to Layoffs.fyi, Amazon has laid off 27,000 employees since November. Although this figure is substantial, it represents less than 4% of the workforce they added over the past two years.

A similar situation unfolded at Meta. The parent of Facebook expanded its workforce by 60% during the pandemic, but its layoffs in 2022 and 2023 account for approximately 13% of its total headcount. Using a little basic math, that means even after these significant job cuts, Meta still has 39% more workers than it did prior to the pandemic.

Just like a stock market correction, big short-term changes (in any direction) usually lead to a swing in the opposite direction, and in the end, things settle down somewhere in the middle. This is what people often call the pendulum effect.

All three examples — SVB, Amazon, and Meta — highlight the importance of keeping our eyes on the big picture and making smart decisions, instead of getting swept up in the rollercoaster of short-term economic ups and downs.

In my lifetime, there is no comparison to the disruption of life that was caused by the pandemic. Probably the closest thing that comes to it is 9/11, and the consequential wars that followed. Two decades later, 9/11 has lasting effects, which we are reminded of everytime we go through airport security. (Remember when your family was there to greet you at the gate?)

The pandemic is barely in our rearview (and with 600 people still dying daily from Covid, you can argue it’s still not over), but it seems like people have already forgotten it happened.

We’re not giving enough attention to the impact of this shared trauma. From kids missing two years of in-person schooling and countless businesses being forced to close, to the limited contact with our friends and families, the scars from the pandemic effects continue to disrupt our lives and will for quite some time.

Similarly, the current economic landscape reflects the ripple effects of the rapid changes brought on by the pandemic. Inflation, layoffs, bank failures, and more can all be traced back to the pandemic.

Will there be a recession? It’s quite possible, given the current economic indicators, but it’s hard to say for sure.

Rather than focusing solely on whatever label is placed on it, it’s crucial for entrepreneurs to remain adaptable and prepared for any economic environment. By staying informed, making well-thought-out decisions, and being willing to challenge the status quo, entrepreneurs can find opportunities and thrive even when the economic outlook seems bleak.

In other words, success often lies in the ability to swim upstream when everyone else is going with the flow.

In the fast-paced world of startups, it is vital for entrepreneurs to adopt a long-term perspective and maintain a steady pace. Even if the economic headwinds appear unfavorable, don’t let that stop you from opening your dream restaurant. People still need to eat. But at the same time, consider the potential implications of a recession on your startup and remain flexible. Deliberate, well-thought-out decisions are always preferable to hasty choices based on isolated events.

While you focus on making well-informed decisions, remember that not everyone will follow suit. As highlighted in this article, both businesses and individuals are prone to overreact to changes. As an entrepreneur, it’s essential to stay alert and tap into opportunities arising from these varied responses. Take, for example, the California Gold Rush — most prospectors didn’t strike it rich; instead, it was the savvy suppliers of tools and essentials, such as rugged denim jeans, who reaped the rewards. But beware of passing fads. Fortunately for Levi’s, jeans are timeless, but as the gold rush subsided, I bet there were a lot of people stuck with an inventory of useless pickaxes.

Entrepreneurs are at the forefront of driving constant change, embracing innovation and adapting to shifting markets and trends to address consumer needs. While the specific economic conditions may shift, the fundamental principles of successful entrepreneurship remain the same. Rather than seeking out a “recession-proof” business, you should instead focus on a good idea and then adapt your strategy to the current economic situation. Market conditions will change, but people will always seek solutions to their problems, and successful entrepreneurs are the ones who can provide those solutions, regardless of the economic landscape or trends.

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...