How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

4 min read

![]() Masterplans Staff

Sep 10, 2022 11:26:01 AM

Masterplans Staff

Sep 10, 2022 11:26:01 AM

By partnering with Foundersuite, Masterplans clients get their pitch materials in front of potential investors

Throughout our 18+ years of helping clients developing business plans and pitch decks, we’ve discovered Masterplans’ clients often run into a similar problem: they have amazing pitch documents but few prospective investors to pitch.

The reality is Angels and Venture Capitalists are intermittently active, targeting variety of startup stages, and siloed by industry, which equates to a list of active investors and interests that are constantly shifting. There is an entire sector of businesses tracking the ebb and flow of the investment community (more on these later). And while there is no single resource is a silver bullet that will guarantee funding for your startup, diligence, planning, and research by you, the startup’s founder(s) — combined with the correct tools and resources to navigate this process — can dramatically increase your chances of success.

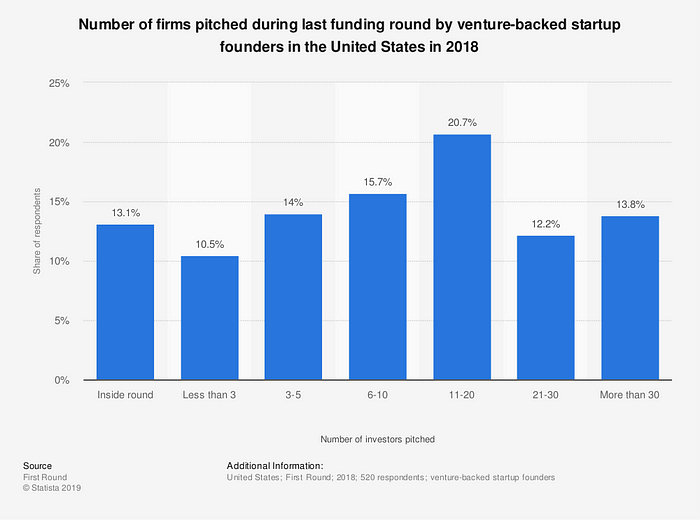

Like all forms of marketing and solicitation, fundraising for a startup is a numbers game, and unless you have a ton of traction and metrics to back it, or you have previously taken other companies public, you are going to need to talk to a lot of investors.

A pretty typical pitch-to-commitment ratio is around 5%, so if you’re looking to secure a group of 5 Angel Investors to fund your seed round, you’re going to need to start with at least 100 targets for the research. (Source: Foundational)

You might be thinking to yourself, “Where am I going to find and then keep track of all these investors?” Enter Foundersuite, a software platform developed specifically for founders seeking funding. Simply put, Foundersuite is a platform for startups to build an investor funnel, manage that funnel, and build relationships with VCs and Angel investors alike.

How do I build an Investor Funnel? I thought you would never ask.

As I mentioned above, you’re going to need a lot of investors to pitch. But like sales, and so many other aspects of business, you have to start with a wide net and begin to winnow it down. The first step is to build a list of 100–150 names to feed into the top of your funnel. Foundersuite has you covered with a database of 21,000 VC firms and over 100,000 angels, family offices, PE firms, etc.

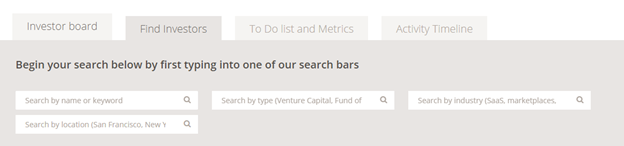

But while you want a large list of potential investors, you don’t want to add just anyone to your investment funnel. Your top-of-funnel should be limited to potential firms and individuals who invest in your specific industry. If your startup is a direct-to-consumer product you don’t want to waste your time pitching investors who only fund real estate projects. If you navigate to the ‘Find Investors’ tab you can search for investors by location, keyword, type, and industry.

If you’re not finding enough viable investors via Foundersuite’s database, there are several other ways to populate your research list, including:

Pro Tip: When choosing your advisory board members keep their investor network in mind. A well-connected advisory board is a great source for prospective investors to populate your list.

Raising startup capital is a marathon, not a sprint. You should begin by pre-marketing your deal 3–6 months before you need capital. Start warming up your investor pool by using Foundersuite’s “Investor Update” tool to compose email newsletters that keep potential investors up to date on your progress as you approach your fundraising window. Foundersuite’s CEO created an excellent guide on creating investor updates here (spoiler alert: it’s all about those KPIs!).

Pro Tip: Permission based marketing is a powerful tool. It’s best to start the relationship with a prospective investor off on the right foot by introducing yourself and asking them if they’re alright with you keeping them updated. Something along the lines of, “I saw that you’ve made investments in <your industry>. We are not currently seeking funding, but we will be in 3–6 months. Would it be alright if I add you to our newsletter list?”

Now that you’ve bought some time for yourself you need to develop your pitch materials. The foundation for a compelling pitch is a sound business plan, comprised of market research, and detailed financial projections. You cannot skip the business planning phase and expect to arrive at a pitch deck that holds up when an investor begins their vetting process. Our expertise at Masterplans is helping people navigate the planning process and arrive at the pitch materials required to secure an investment. We’ve created a deck outlining business planning for investment here.

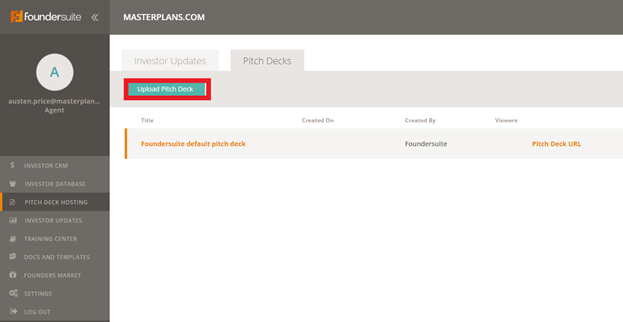

When it’s finally time to begin sharing your pitch deck or one-pager you can upload them to Foundersuite’s “Pitch Deck Hosting” tool. Hosting pitch materials in Foundersuite allows startup founders to track engagements and thereby gauge interest from prospective investors.

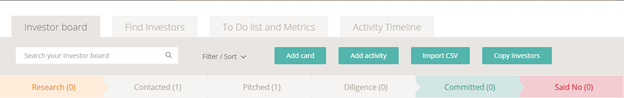

As you research, network, and pitch, you can track your progress and advance prospective investors through the investment life cycle from Research > Contacted > Pitched > Diligence > Committed. It’s critical to maintain communication with potential investors. If they ask a question you don’t know the answer to, you should make a note of it in their record and be sure to respond to them. If an investor recommends a book or podcast, you should use the Investor Board to make sure you don’t forget to read or listen to it. And when you finish that book or podcast, it is an opportunity to check in with that investor again and discuss what your takeaways are. Investors are looking for Founders who are coachable, receptive to feedback, and organized.

As a client once told me, if you’re the founder of an early stage business, you’re either actively raising capital or inactively doing so. It is a long and arduous process, but Masterplans’ clients who are diligent and informed set themselves up to succeed.

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...